accumulated earnings tax reasonable business needs

We have the experience and knowledge to help you with whatever questions you have. Defend against Accumulated Earnings Tax.

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

Exemption levels in the amounts of 250000 and 150000 depending on the company exist.

. The accumulation of reasonable amounts for the payment of reasonably anticipated product liability losses as defined in section 172f as in effect before the date of enactment of the. The primary defense usually levied by the corporation is that the accumulated earnings beyond 25000000 were essential to the reasonable needs of the business. List several examples of.

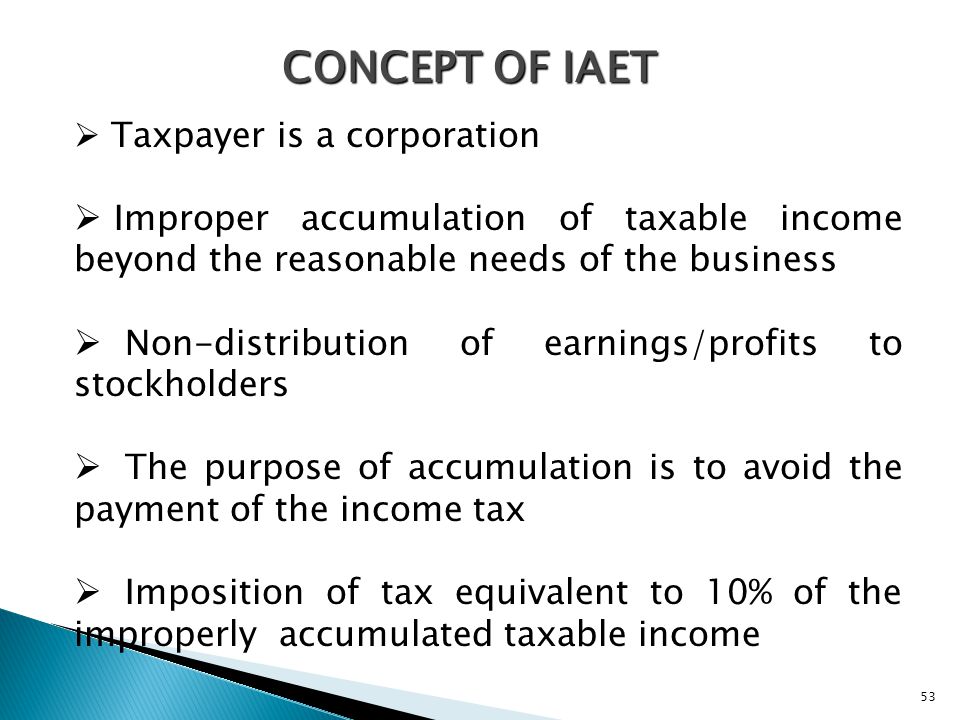

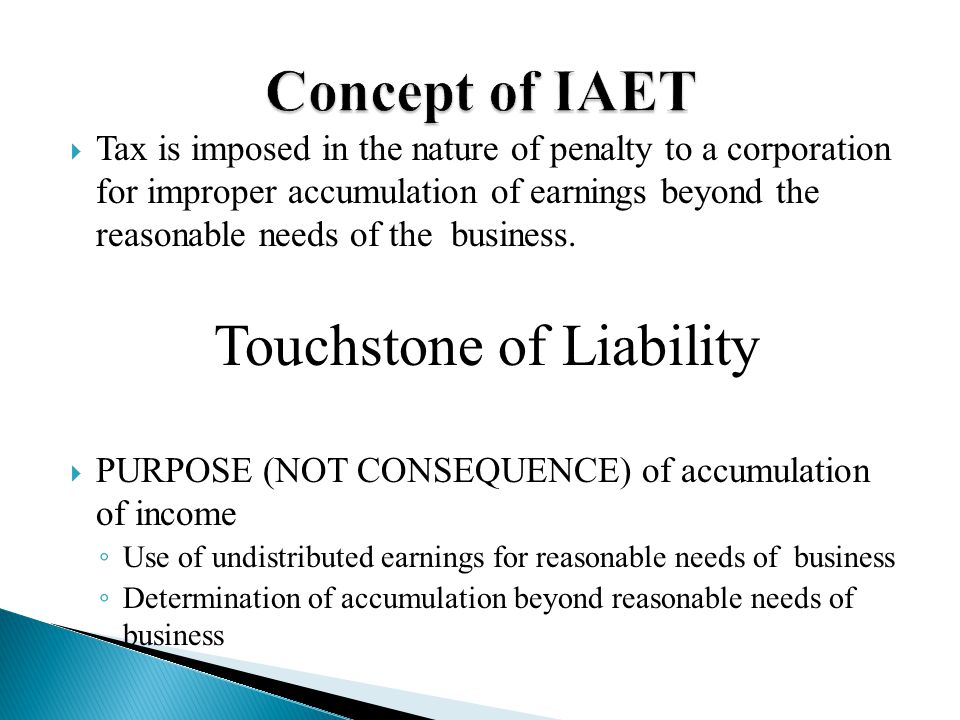

Anticipated needs of the business. However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business. Ad Talk to a 1-800Accountant Small Business Tax expert.

The federal government discourages companies from stockpiling their capital by using the accumulated earnings tax. The IRS also allows certain. Within the reasonable needs of the business rubric.

The Tax Code defines reasonable needs to include the reasonably anticipated needs of the business. An accumulation of the earnings and profits including the undistributed earnings and profits of prior years is in excess of the reasonable needs of the business if it exceeds the amount that. The accumulated earnings tax rate is 20.

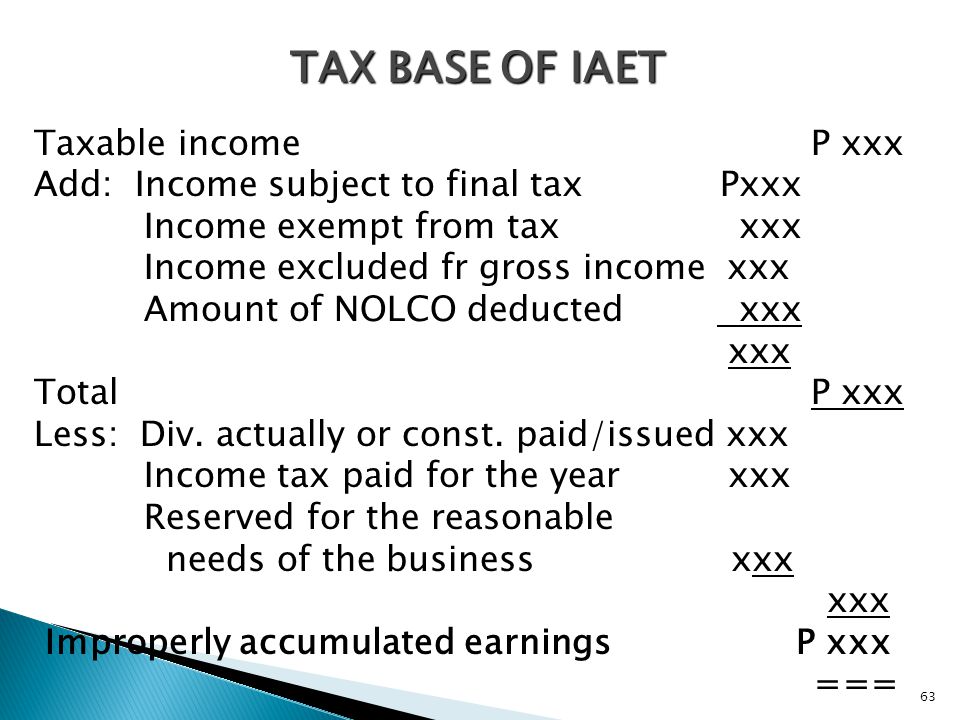

Corporation described in section 532 an accumulated earnings tax equal to the. The AET is a penalty tax imposed. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond the reasonable needs of the.

For purposes of the accumulated earnings tax earnings can be accumulated for reasonable needs of the business. The working capital needs of a business in an accumulated earnings tax case is given a narrower definition and means the liquid assets needed for a regular business cycle. 1 27V2 percent of the accumulated taxable income not in excess of 100000 plus.

Tion 303 relating to payment of a deceased. When the revenues or profits are above this level the firm will be subjected to accumulated earnings tax if they do not distribute the dividends to shareholders. The fact that earnings and profits of a corporation are permit-ted to accumulate beyond the reasonable needs of the business is prima facie evidence of a purpose to avoid income tax2.

September 10 2021 Corporate taxpayers that retain earnings in excess of the reasonable needs of their business rather than pay such earnings as dividends to shareholders. Strategies for Avoiding the Accumulated Earnings Tax. 2 redemptions in connection with sec-.

2 381 percent of. 2-2001 includes as among the items which. Advanced Business Entity Taxation.

Get the tax answers you need. The threshold is 25000.

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Accounting Principles And Business Transactions Cheat Sheet Accounting Principles Accounting Accounting Education

The Impact Of The Tax Cuts And Jobs Act S Repatriation Tax On Financial Statements The Cpa Journal

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Earnings And Profits E P In Corporate Income Tax Tax Notes

Doing Business In The United States Federal Tax Issues Pwc

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Improperly Accumulated Earnings Mpcamaso Associates

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc Tax And Accounting Center Inc

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Explore Our Example Of Small Business Payroll Template For Free Payroll Template Payroll Payroll Software

Learn The Meaning Of Post Trial Balance At Http Www Svtuition Org 2013 07 Post Closing Trial Balance Html Trial Balance Accounting Education Learn Accounting